-

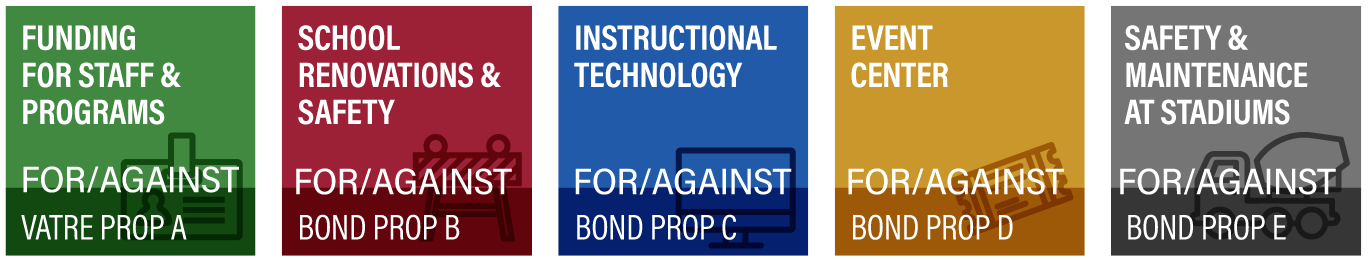

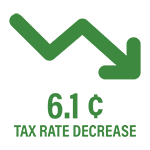

The PISD Total Tax Rate Will Be 6.1 Cents Lower than Last Year with Voter Approval of the VATRE and Bond Propositions.

The PISD Total Tax Rate Will Be 6.1 Cents Lower than Last Year with Voter Approval of the VATRE and Bond Propositions.How can the total tax rate be lower if additional funding is approved by voters?

The state legislature passed House Bill 3 a few years ago to provide property tax relief to homeowners. As a result, Plano ISD’s Maintenance & Operations (M&O) rate has decreased 14.8 cents in the last five years. Visit the Tax Information Page to Learn More.As Taxable Assessed Values have increased, it has created additional bonding capacity for Plano ISD. Plano ISD can afford to issue the $1.49 billion worth of bonds at the current Interest & Sinking (I&S) tax rate of $0.2374 per $100 valuation. This means that the tax rate will not increase as a result of voters approving the four bond propositions.