- Plano Independent School District

- Bond Programs

-

Bond Refunding Transaction Saves Taxpayers Over $77.6 Million

Updated on April 14, 2016At the April 5 school board meeting, Plano ISD's CFO Steve Fortenberry and the financial company FirstSouthwest presented a bond refunding report showing favorable results and savings for the school district; more favorable, in fact, than original projections.

As a result of board action taken at the February 2 Plano ISD school board meeting, the district entered into a bond refunding transaction on February 24, which resulted in a total debt service savings of $77.6 million and a net present value savings of $55.4 million. Due to the amount of demand for the district's bonds, Plano ISD was able to lower the yield of certain maturities by an additional 0.01% to 0.05% during final pricing. The transaction replaced more than $342 million of bonds issued in 2006-2008 with new bonds issued at a lower effective interest rate. Total future payments will drop from $485.6 million to $408 million, or a net decrease of 16%.

"This transaction demonstrates the school district's commitment to reducing debt," said Mr. Fortenberry. "We are proud of the way we've saved tax payers money. We decided to focus on shortening the debt by more than four years and placing the savings at the end of the debt schedule instead of today. It was fiscally prudent to get the debt paid off even quicker."

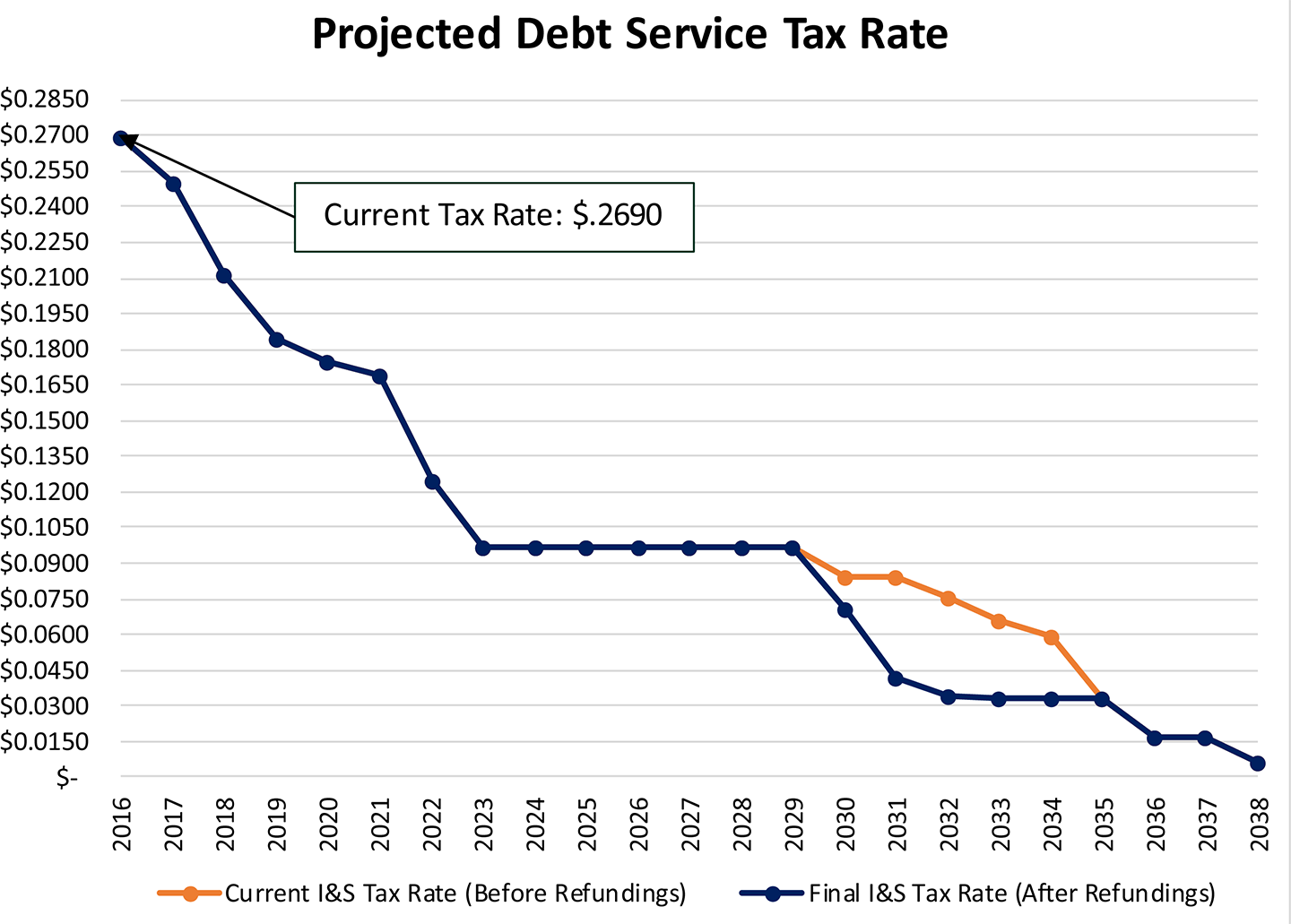

The analysis above assumes that the school district's taxable assessed value will grow by 5% in years 2017-2018, 4% in year 2019, 3% in years 2020-2021 and then 0% thereafter. This analysis does not take into account any future bond issuances by the district.

Click here to view a larger version of this chart.

The refinancing strategy essentially maintains currently scheduled payments through the year 2029, decreases the 2030 payment by $6.5 million and completely eliminates the $71.1 million of payments scheduled for 2031 through 2034.

"This refinancing is assumed to be the largest and most financially beneficial in district history," Mr. Fortenberry said.

Combined with other refinancing transactions over the past ten years, district taxpayers have now saved $119.3 million in principal and interest payments on debt.

Original Post: March 1, 2016

On February 24, the Plano ISD entered into a bond refunding transaction that saves taxpayers more than $77.6 million in future payments on outstanding debt. The transaction replaced over $342 million of bonds issued in 2006-2008 with new bonds issued at a lower effective interest rate. Total future payments will drop from $485.6 million to $408 million, or a net decrease of 16%.

The refinancing strategy essentially maintains currently scheduled payments through the year 2029, decreases the 2030 payment by $6.5 million and completely eliminates the $71.1 million of payments scheduled for 2031 through 2034.

This refinancing is assumed to be the largest and most financially beneficial in district history. Combined with other refinancing transactions over the past ten years, district taxpayers have now saved $119.3 million in principal and interest payments on debt.

For details, read this Summary of Annual Savings

-

"This transaction demonstrates the school district's commitment to reducing debt. We are proud of the way we've saved tax payers money. We decided to focus on shortening the debt by more than four years and placing the savings at the end of the debt schedule instead of today. It was fiscally prudent to get the debt paid off even quicker."

Steve Fortenberry, CFO